Zehrid Osmani, Portfolio Manager, Martin Currie Global Portfolio Trust

Sustainable investing has entered into the mainstream. With issues such as climate change and plastic pollution dominating the headlines, many investors are now much more aware of how their money is being put to use and want to align this with their values.

But when it comes to actually investing sustainably, it can be difficult to know where to start.

The problem is made worse by the multitude of funds now proclaiming sustainability credentials – the so-called ‘greenwashing’ effect. Fortunately, legislation coming soon should bring greater clarity for investors on this issue, but we believe there are some other, simple steps to help gauge a fund’s commitment to sustainability:

Sustainability pedigree

It’s good to know which asset managers actually have long-standing, rather than just recent, experience in this area. Look for early commitments to the PRI and being signatories to stewardship codes as an indication of their commitment before it became ‘fashionable’.

Beware the labels

Likewise, don’t be taken in by the appeal of ‘green-sounding’ fund names. Instead, trust independent ratings agencies to provide a reliable calculation of a portfolio’s sustainability. For example, the Martin Currie Global Portfolio Trust is the holder of the highest Morningstar Sustainability Rating™* – recognition of the high standards and in-depth analysis undertaken as part of its stock selection process.

The trust is also in the top 2% of all the 6,747 products categorised by Morningstar as Global Equity Large Cap*.

What do others say?

A simple guide to assess an asset manager’s focus on sustainability can be gleaned from how others rate them. For instance, Martin Currie has been awarded highest level UN-supported Principles for Responsible Investment (PRI) rating (triple A+) for four years in a row, which means it is well regarded within the asset management industry.

Go active

An active asset manager (rather than a fund that just passively tracks stocks in an index) has the ability to operate in much more sustainable manner. Many ‘engage’ with companies, pushing for best practice and holding them accountable to environmental, social and governance (ESG) standards.

Positive outcomes

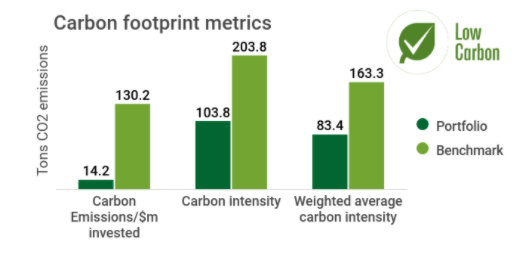

Finally, all sustainable investors will want to know that they are making positive difference, in particular on the issue of climate change. Martin Currie Global Portfolio Trust has been awarded a low carbon designation and accounts for a fraction of the emissions of the benchmark index.

Source: Martin Currie and MSCI as at 4 January 2021. Martin Currie Global Portfolio Trust shown. Index is MSCI All Countries World Index.

Sustainable investing is a fundamental part Martin Currie Global Portfolio Trust’s philosophy. Find out more about its approach to ESG and stewardship at www.martincurrieglobal.com

Zehrid is a panellist at The Scotsman’s free Annual Investment Conference on Tuesday 30th March in association with Martin Currie Global Portfolio Trust and Rathbones. Register here.

Other webinar panelists include David Coombs, Head of Multi-Asset Investments, Rathbones and Iona Bain, Writer, Speaker, Broadcaster and Blogger specialising in young finances.