After a very strong climb for global stockmarkets, investors could be forgiven for thinking that all regions must be priced for perfection.

Indeed, it would be a stretch to argue that key markets, such as the US, now offer great value, following an epic bull run since the financial-crisis trough in 2009. Lest anyone forget, this has taken place against a backdrop of ultra-low interest rates and what are still far from rosy economic conditions.

Asian markets have risen strongly too, but do not look as expensive, whether compared with other markets or their own history. And the kicker? This relative cheapness comes despite better economic fundamentals, including high employment levels and growing incomes, which provide support for regional consumption; not to mention, at the corporate level, a strong earnings’ (now also revenue) recovery and record piles of cash on company balance sheets.

Source: Martin Currie and Bloomberg. Indices used: MSCI AC Asia ex Japan and MSCI World. 10 years to 31st January 2018.

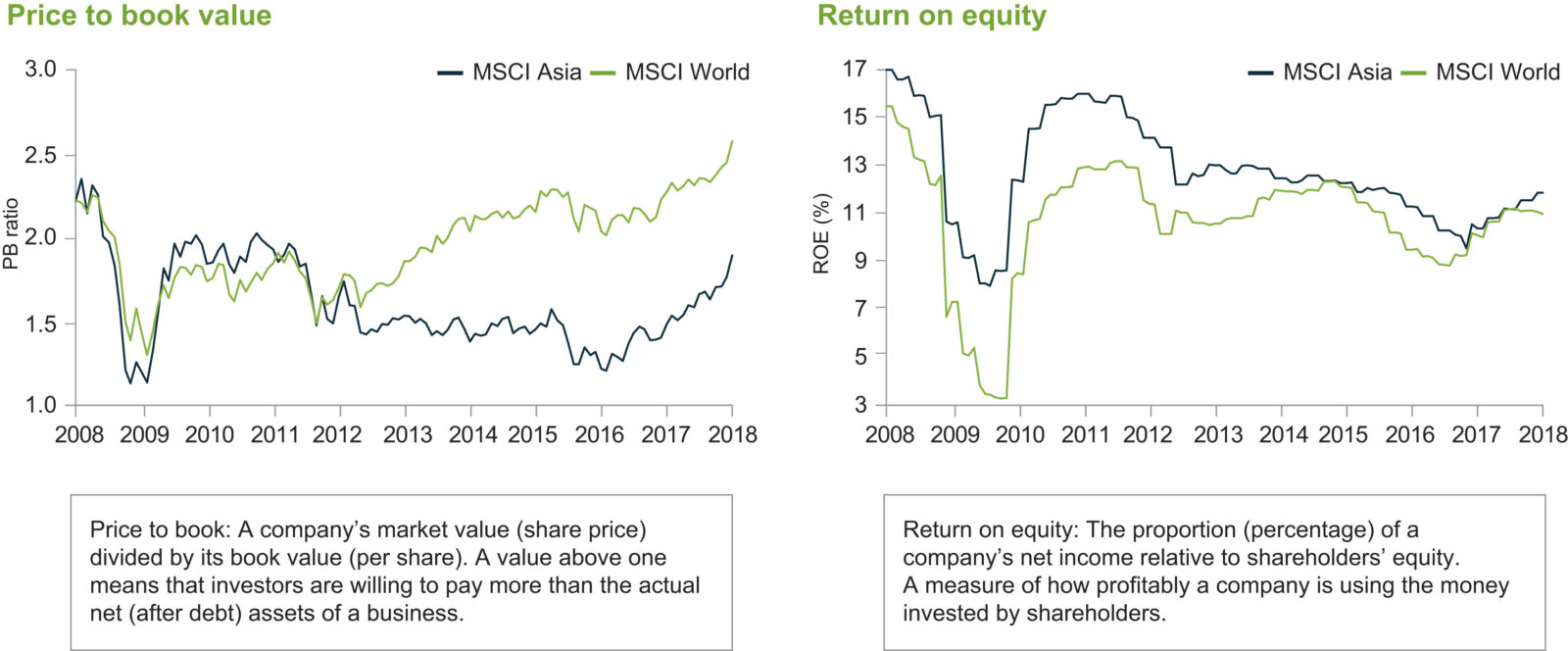

Looking at simple valuation measures such as the price to book (p/b) ratio – which shows how much the market is paying for a company’s net assets (after debt has been deducted) – Asia’s discount to the world is evident. Granted, this measure has risen above the levels seen in recent years, but is closer to historical averages over longer time periods (which isn’t the case in many other markets).

Importantly, over the past year, Asia’s improving valuations have been supported by improvements in return on equity (ROE) for the market, reversing a negative trend that lasted several years. That means many Asian companies are cheaper than their US or European counterparts, despite generating similar or superior profits relative to the money shareholders have invested.

Bulging cash balances

Notably, the earnings recovery in Asia last year was the strongest in seven years. While the pace of gains is likely to ease, corporate earnings will remain healthy. Combined with the more recent broad-based rebound in company sales this bodes well for market sentiment.

Some Asian companies are sitting on veritable war chests – regional non-financial corporations boast approximately US$1.8 trillion of cash & equivalents. That’s around 35% of their market capitalisation, the highest level ever recorded. This could be great news for shareholders as companies could increase dividends and buybacks. It also provides a significant buffer for rainy days or for further investment that can increase future profitability.

Separating the wheat from the chaff

Of course, all of the above refers to the market as a whole, and not every company is in a strong position, or has the potential to grow and thrive. Selectivity remains key. In our view, this means spending time and effort to identify companies with quality management teams and strong franchises, that can capture the strong economic growth in the region.

Finding these long-term winners requires a disciplined process, dissecting financial track records, as well as examining competitive positioning, strategic direction and broader factors that can impact the sustainability of corporate performance.

And, critically, during times of market jitters – like the recent episode we’ve seen – such an undivided focus on company fundamentals can turn volatility from an enemy to a friend for stockpickers like ourselves.

By Martin Currie Investment Management Ltd

www.martincurrie.com

IMPORTANT INFORMATION

This information is issued and approved by Martin Currie Investment Management Limited. It does not constitute investment advice.

Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.